RWA Platform Introduction

A decentralized infrastructure for real-world asset capital markets

What is RWA?

Real-World Assets (RWA) are tokenized representations of physical or traditional financial assets on blockchain. Examples include:

- Fixed Income — Bonds, treasury bills, credit products

- Real Estate — Property shares, REITs, land rights

- Commodities — Gold, oil, agricultural products

- Revenue Rights — Royalties, licensing fees, project revenues

- Infrastructure — Energy projects, data centers, transportation

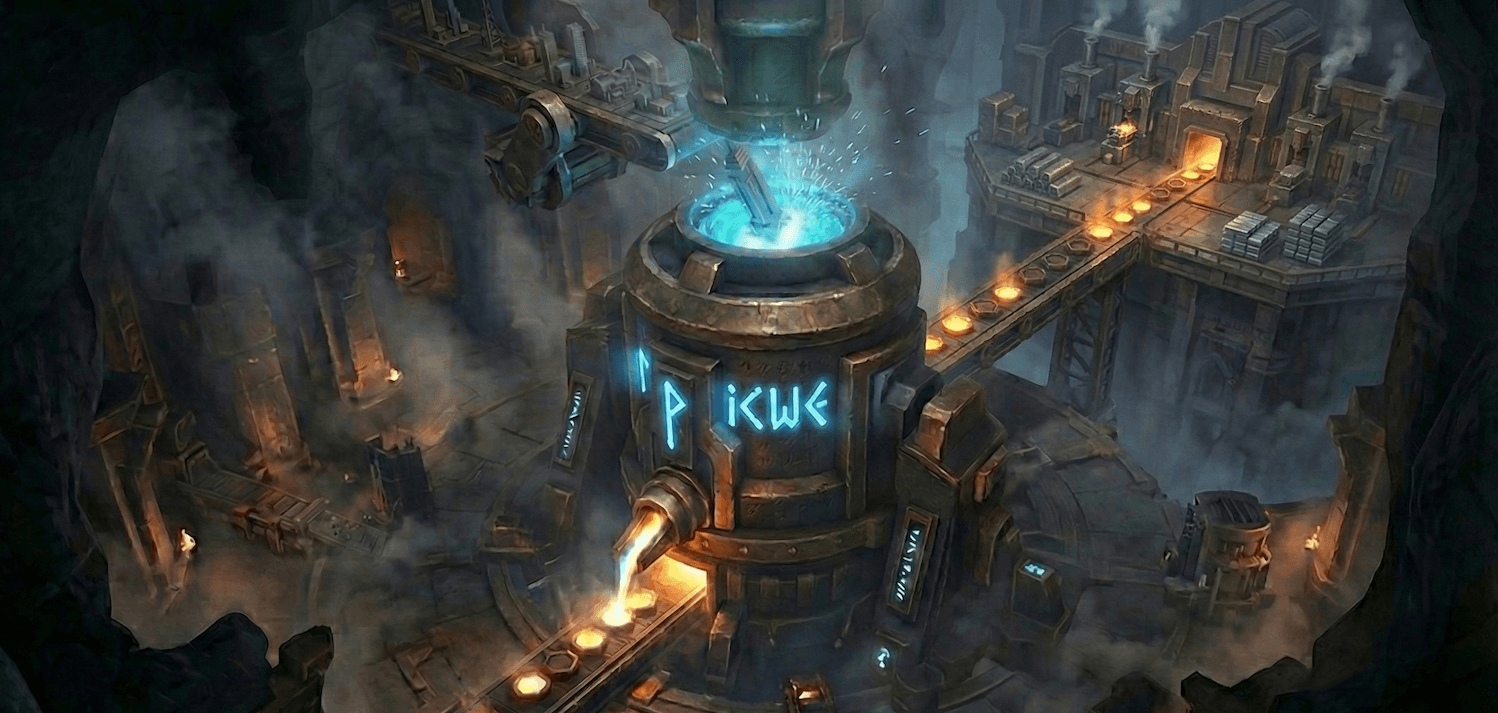

PicWe’s RWA Platform

PicWe provides a complete infrastructure for RWA capital markets:

Core Components

1. IRO — Initial RWA Offering

The entry point for new RWAs:

- Permissionless issuance via smart contracts

- Whitelist and public offering phases

- Standardized parameters and investor protections

2. Origin Mincast — Minting Protocol

Revolutionary liquidity mechanism:

- Mint (mincast) tokens by depositing WEUSD

- Burn (melt) tokens to withdraw WEUSD

- Dynamic pricing with floor price protection

Learn more about Origin Mincast →

3. Invest Module — Structured Investments

Independent investment platform for R1-R2 assets (very low to low risk):

- Multi-source asset platform (Origin Mincast assets + institutional partners)

- Institutional partnerships (e.g., DigiFT for US Treasury bonds, corporate bonds, stocks)

- Risk-graded asset classification (focuses on R1-R2)

- Investor profile matching (C1-C5)

- Fixed-term investments with defined APY

Key Feature: The Invest Module serves as an independent platform primarily for R1-R2 assets from various sources, including compliant institutional partners.

Learn more about Invest Module →

Key Features

Decentralized Operations

- All operations executed by smart contracts

- No central authority or intermediaries

- Transparent, auditable on-chain records

Single-Chain Issuance, Omni-Chain Access

- RWAs issued on one chain (source of truth)

- Accessible from all supported networks via WEUSD

- Cross-chain settlement without bridges

Floor Price Protection

- Every RWA token has a guaranteed minimum value

- Floor price only increases, never decreases

- Mathematical guarantee backed by protocol reserves

Permissionless Participation

- No KYC required for eligible assets

- Global 24/7 access

- Low minimum investment thresholds

Supported Networks

| Network | IRO | Origin Mincast | Invest |

|---|---|---|---|

| BNB Chain | ✅ | ✅ | ✅ |

| Base | — | — | — |

| Arbitrum One | — | — | — |

| HashKey Chain | — | — | — |

| Plume Chain | — | — | — |

| Movement | — | — | — |

RWA platform features currently available on Bnb Mainnet. Other networks support WEUSD operations.

Next Steps

- IRO — Learn how to issue or invest in RWAs

- Origin Mincast — Understand the minting protocol

- Invest Module — Explore structured investment options

Last updated on